At times corporations need to make investment decisions. These decisions are important as they help firms build up their assets and future cash flows, at the same time would need considerable investments.

An important aspect of these investments is the time value of money, i.e. cash received earlier has more value than cash received at a later time.

Stages in Capital Budgeting

- Stage 1: Investment screening and selection

- Stage 2: Capital budget proposal

- Stage 3: Budgeting approval and authorization

- Stage 4: Project tracking

- Stage 5: Post-completion audit

Financial Appraisal tools for Capital Budgeting

Payback Method: The payback period is the number of years it takes to recover the project cost. The payback method helps understand projects’ risk and liquidity and is easy to understand. On the downside, it does not consider the time value of money (TVM) and does not consider cash flows after the payback period.

An alternate to payback method is discounted payback, where instead of exact Cash Flow (CF), a discounted CF is considered to take care of TVM.

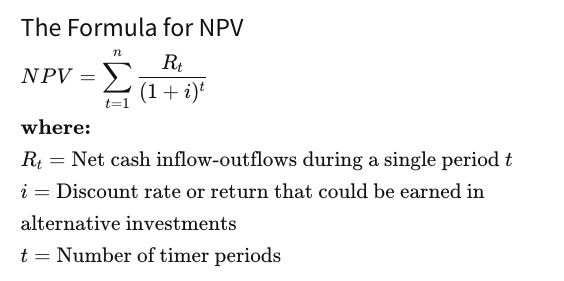

NPV: An important tool to evaluate projects is NPV or Net Present Value. In simple terms, NPV is is the difference between the present value of cash inflows and the present value of cash outflows over a period of time. If NPV>0, the project can be considered for acceptance.

Any project with NPV>0 is profitable. The higher the NPV, the more profitable is the project. So in the case of mutually exclusive projects (the only one that can be chosen), the one with higher NPV is preferred.

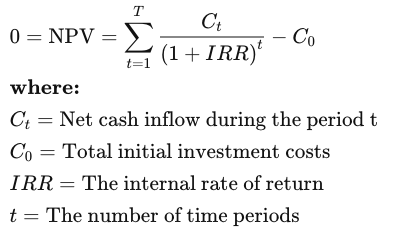

IRR or Internal Rate of Return: “The internal rate of return (IRR) is a metric used in financial analysis to estimate the profitability of potential investments. IRR is a discount rate that makes the net present value (NPV) of all cash flows equal to zero in a discounted cash flow analysis.” – investopedia.com. A Higher IRR rate makes the project more desirable.

To calculate IRR, set NPV=0 in the NPV formula mentioned above.

If IRR>WACC (Weighted Average Cost of Capital), the project is profitable.

Sunk Cost: Sunk cost is a cost that has already been incurred and as such, exists irrespective of whether the project is undertaken or not. For example the salary of the employees. This cost should not be considered as part of project cash flows.

Opportunity Cost: For example, if the company has land which is to be used to set up a factory for the current project. This cost will be added to the project.

Profitability Index: When comparing multiple projects of different sizes, directly comparing NPV might not make sense as one project might be worth 10000 and another might be 1000000. Profitability index or PI is calculated as NPV/ Initial investment and helps us calculate profit generated per dollar invested. A PI> 1 means the project is profitable.